Most Irish businesses expect to boost wages this year as they face further pay pressure from workers, a new report says.

A survey released late on Sunday says rising exports have combined with easing energy and raw materials costs to boost optimism among Irish enterprises.

“Nevertheless, challenges look set to persist in the form of wage pressures,” states the Accenture/S&P Global Ireland Business Outlook.

Most firms expect staff costs to rise over the next 12 months, the report notes. “A net balance of 64 per cent of Irish private sector companies believe wages will rise, up from 59 per cent in the previous survey period,” it adds.

The survey, completed in June, states 30 per cent of companies plan to hire more staff in the coming months, which is the highest number since February last year and the “strongest level of confidence worldwide”, states the survey.

A breakdown shows services more upbeat about employment, with one in three of them preparing to take on more workers, against just one in four manufacturers.

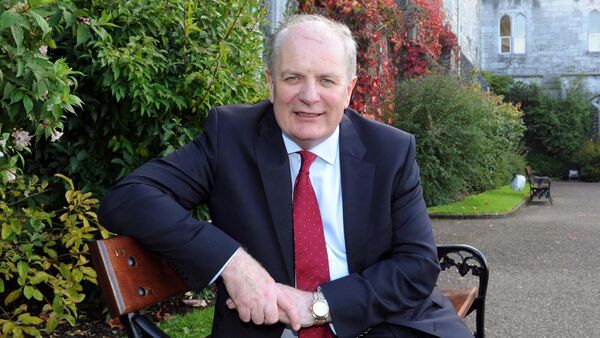

Hilary O’Meara, country managing director at Accenture in Ireland, said that the Republic’s growth forecast was the strongest globally.

“The nation’s growth indicators have remained resilient across the year and it’s encouraging to see an overall cooling in inflation expectations,” she added.

“There remain challenges around wage pressures, labour shortages and strong market competition but there is a lot to be optimistic about.”

The number of companies predicting non-wage costs to rise fell to 42 per cent from 44 per cent in February, the report shows, indicating weaker inflation.

Businesses hope to pass these costs on to customers, but the actual number of companies intending to hike their prices is down to 28 per cent from 31 per cent in February.

Overall, rising costs look more likely to hit services than manufacturing, Accenture believes.

More companies expect a boost to their bottom line as inflation eases, says the report.

One in four of the businesses surveyed now expects profits to grow, up from 21 per cent in February this year, it shows.

“This was the strongest reading since February 2022 and the third-strongest globally,” Accenture notes.

Irish companies have mixed views on investing in their businesses. The number with capital spending plans fell to 13 per cent in the current survey, from one in five in February.

Research and development spending was highlighted by 6 per cent of respondent companies, which Accenture says was the strongest in a year.

Irish investment plans compare favourably with the rest of the euro zone, where just 7 per cent of businesses intend putting more cash into their businesses, or globally, where the figure is one in 10.